Why CRO Win Rates Matter

- Sep 15, 2016

- 5 min read

“Lumpy”, “Unpredictable” and “Challenging” describe what its like trying to estimate new sales (i.e. awards) at small to mid-size clinical research organizations (CRO). The objective of this blog is to discuss how win rates can help identify a CRO’s “sweet spots” and can improve both productivity and profitability.

Win Rates

Win Rates can be defined as the ratio of opportunities won to total opportunities closed (or the percentage of time an opportunity is won).

I typically track two types of win rates: Dollar and Number. Here are the formulas:

Dollar ($) Win Rate: $ Value Won / ($ Value Won + $ Value Lost)

Number (#) Win Rate: # of Awards Won / (# of Awards Won + # of Awards Lost)

Change orders and cancelled opportunities are excluded

Here is a simple example:

Dollar and number win rates both have weaknesses when taken at face value:

Dollar win rates can be skewed by high value awards. For example, one $10M award and twenty losses worth $20M would show a dollar win rate of 33.33% ($10M / ($10M + $20M)) while the opportunity win rate would only be 4.7% (1 / (1+20)).

Number win rates can be skewed by many low value awards (i.e. lots of awards but not enough value).

However, win rates taken in tandem along with other metrics can provide a great deal of insight. Acceptable win rates in the CRO industry tend to be between 25%-35%.

A Little More Detail

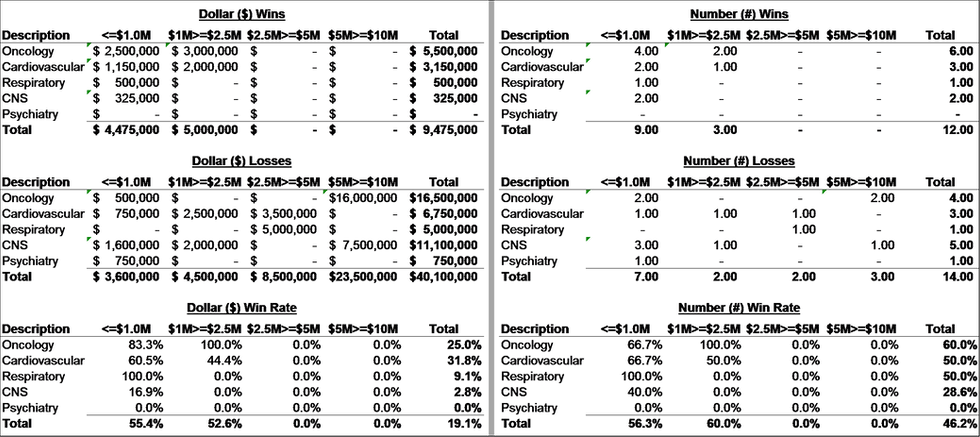

Let’s take a look at the full dataset used to calculate the example above:

Adding therapeutic and opportunity value provide additional color. Win rate data can be mined numerous ways, common approaches are by business unit, trial size, therapeutic expertise, geography, client category and even by salesperson. Here are win rate calculations by opportunity size and therapeutic expertise:

A few observations:

The total oncology dollar and number win rates are 25% & 60%

The total cardiovascular dollar and number win rates are 31.8% & 50%

Total dollar & number win rates for opportunities <= $2.5M are between 50%-60%.

Total dollar & number win rates for opportunities > $2.5M are 0%

Respiratory & CNS show potential for smaller opportunities (<= $2.5M).

Translation:

Business development would be wise to target oncology & cardiovascular trials up to $2.5M

Respiratory and CNS opportunities up to $2.5M would be a secondary focus

Limit attempts on opportunities > $5M

Opportunity Cost

Opportunity cost can be defined as “cost of passing up the next best choice when making a decision”. Using our scenario, the opportunity cost of chasing a low probability sale is the lost ability to focus on a high probability sale. Seems simple enough, but less so when taking into consideration all the competing priorities in a CRO:

Company, business unit, regional and individual sales targets

Competition for internal operational resources

Monthly, quarterly or annual proposal quotas

Trying to make or save the quarter with a large award (i.e. elephant hunting)

Win rate data can help instill the discipline required to effectively implement an effective proposals triage process. Understanding where a CRO is most successful is invaluable. The outcome is working smarter (narrow focus on high probability opportunities) rather than harder (wasting time on low probability opportunities).

Improving Profitability

Let’s talk about how win rates can improve profitability. Let’s use the following conservative assumptions related to the time and cost of chasing an opportunity:

100 hours of internal time (proposals, business development, operations, etc..) spent putting together a proposal, study budget and preparing/delivering a bid defense.

$100/hr internal labor cost rate

Average domestic and international travel costs of $949 and $2,600 per person

Five employees attending a bid defense

Add it all up and the total cost of chasing a low probability award could easily be $25,000 (conservative considering I’ve been to bid defenses with as much as ten fellow employees from around the world). Aggressively competing for five low probability opportunities per quarter (20 annually) could cost more than $500K annually.

Baseball and Win Rates???

Last year while I was CFO at Theorem Clinical Research (now Chiltern International), I was asked to present at our annual global sales meeting. I decided to focus on win rates but wanted to do so in a way that would be visually easy to understand. I decided on comparing win rates to batting averages (the ratio of hits to at bats in baseball). I had recently read Ted Williams’s book “The Science of Hitting” and decided to relate his batting approach to the CRO triage process. Mr. Williams explains that picking the right pitch (i.e. opportunity) greatly increases your odds (i.e. win rate) of getting a hit. Below is a picture from his book that demonstrates the pitch locations where Mr. Williams had the most success.

Higher numbers represent more success (keep in mind that a batting average of .300 is considered excellent). The red, orange and yellow colored circles were Mr. Williams’s sweet spots – a .300-.400 average when he targeted pitches in those locations. Mr. Williams’s weak spot was the bottom, outside corner (gray shaded areas), where his average was between .230-.275. Everywhere else he hit close to .300. Logical, as pitches in the middle of the plate are easier to hit than pitches low and outside. The key takeaway was his discipline to limit his attempts at low probability pitches enabled him to finish his career with a .344 batting average (which is excellent). If you include his ability to draw a walk (attempts that don’t end in a hit or an out, but the batter getting on base via the discipline to not swing at 4 poor pitches), Mr. Williams made it on base 48% of the time (best in Major League Baseball History).

So what does Ted Williams’s strike zone have to do with Theorem’s annual sales meeting? I used Mr. Williams’s picture and layered on Theorem’s win rates so that the sales team could gain a better understanding of where they (and Theorem) had the best chance to experience success. Here is what the strike zone would look like using dollar win rates from our previous example:

Clearly, oncology, cardiology and respiratory opportunities up to $2.5M are the sweet spots in this example. Focusing on these therapeutic areas and opportunity sizes should translate into high win rates and award values.

Wrapping Up

Win rates are just one data point among many when managing a successful CRO. Win rates should be used in tandem with other metrics and weaved into your company’s strategy. Sometimes there are reasons to chase low probability opportunities:

The chance to present in front of a new customer

An organizational belief that the company can win a larger opportunity due to strong therapeutic expertise

Attempts to enter a new therapeutic or geographic market

Good old fashioned calculated risk

I believe that the numbers shouldn’t always drive a decision, but understanding the numbers before making a decision is critical. Utilizing win rates enable managers to be informed decision makers – which is the point of utilizing data in the first place.

Jason Monteleone is President of Pivotal Financial Consulting, LLC, a Strategic Financial Consulting firm focused on serving the clinical research industry. He can be reached at jmpivotalfinancial@gmail.com.

Comments